Invoicing is an important process in any business. Unfortunately, it’s also a laborious process that requires accuracy. With technology advances, businesses have tried to use various means to ease the invoicing process. Some outfits send scanned invoices; others might transfer PDFs through email; and some still use manual invoices. In this technology age, businesses are choosing to automate functions in a bid to increase overall business productivity and efficiency. E-invoicing is a technology that promises to help entrepreneurs add value to their businesses.

Invoicing is an important process in any business. Unfortunately, it’s also a laborious process that requires accuracy. With technology advances, businesses have tried to use various means to ease the invoicing process. Some outfits send scanned invoices; others might transfer PDFs through email; and some still use manual invoices. In this technology age, businesses are choosing to automate functions in a bid to increase overall business productivity and efficiency. E-invoicing is a technology that promises to help entrepreneurs add value to their businesses.

What is E-Invoicing?

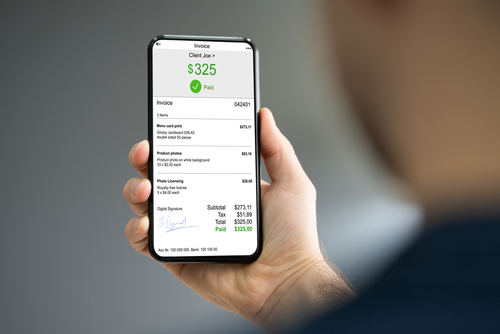

E-invoicing is the exchange of an invoice between a buyer and seller using an integrated electronic format. This allows the buyer to pay online through a card payment, direct debit or other option after receiving the e-invoice.

E-invoicing is not a new technology; it’s already used by large scale businesses and governments. Some governments have already mandated the use of e-invoices from their suppliers and even for taxpayers. These programs have been running onsite, making it expensive for small and medium businesses (SMB) to use. Another challenge for SMBs has been dealing with multiple providers who have different platforms and technologies. This is a challenge because it requires a business to support extra business processes when sending or receiving invoices.

However, the rise of cloud computing and Software as a Service (SaaS) technologies has become an enabler for SMBs to implement e-invoicing.

Making e-invoicing available as SaaS eliminates complicated system installations and integrations that have previously been a challenge to SMBs. The SaaS systems come with features that allow you to automate the invoicing process, send reminders, accept online payments and generate reports, among other things.

Benefits of E-Invoicing

Here are some reasons that businesses are moving to e-invoicing:

- Eliminates the manual process of sending invoices between a buyer and seller.

- Prevents human error with the use of a template. The automated e-invoice ensures correct data is used with a validation process. This ensures there is no mistyped information, no data entry errors, no double entry, missed details or wrong data. Therefore, it improves accuracy.

- Low cost of processing, since it helps to cut down on administration costs and printing invoices. It also saves a business from the task of sending emails back and forth concerning an invoice.

- Maintains a more predictable cashflow as e-invoicing facilitates the seller receiving payment faster.

- Enables ease of tracking invoices as you can track and trace the entire document journey. This means better accounting.

- Enhanced convenience. Businesses create a different number of invoices depending on their transactions. E-invoicing provides a convenient way to store the invoices and easily retrieve them when needed.

- Saves on time so you can concentrate on other business activities. There is no need to waste time looking for client information and entering data every time you need to send an invoice.

- Improves the accounting process. When a business integrates e-invoicing with an accounting system, the invoicing function is faster and easier to handle.

- Enhances invoice security and guaranteed delivery. There is no risk of invoices getting lost in the mail or landing in junk email. Encrypted file transfer and digital signatures are used to enhance security.

- Real-time processing, which allows one to view the live delivery and processing status of an invoice.

- Remote handling as SaaS can be accessed from anywhere. This makes it possible to send an invoice anytime and from anywhere as there is no need for printers or scanners.

Conclusion

The business environment is becoming increasingly competitive and the adoption of technology that automates processes can only help. E-invoicing provides an opportunity for business owners to effectively use their time on growing their business instead of spending it on a labor-intensive administration process. This service also helps SMBs align themselves with large corporations.

Finally, as with any technology, business owners should take time to research which e-invoicing service provider will best serve their unique business needs.

Disclaimer ![]()

![]()